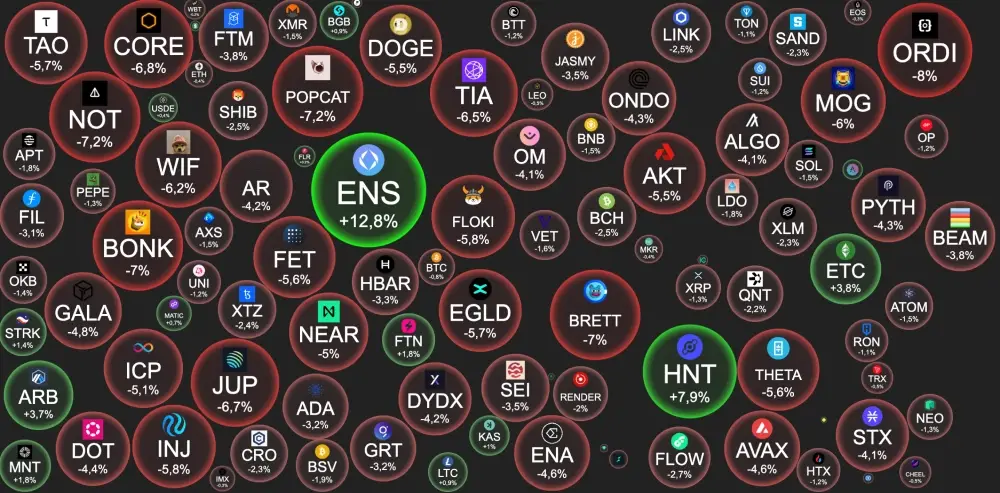

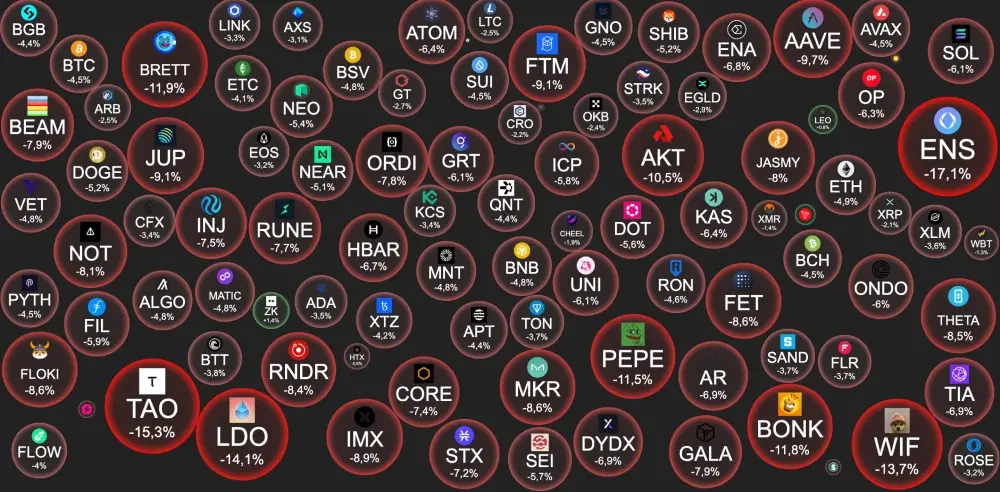

▪️#BTC – $66 423 -0.8%. ▪️🔼 - #ENS , #HNT , #ETC , #ARB ▪️🔽 - #BONK , #NOT , #GALA , #ICP ▪️BTC #dominance- 55.56%. ▪️ #Altseason index 24 ▪️Greed of #investors 58 Our Social Networks : X.com Telegram Facebook Instagram Our Partner in advertise : Visit our New product where we discuss crypto world :

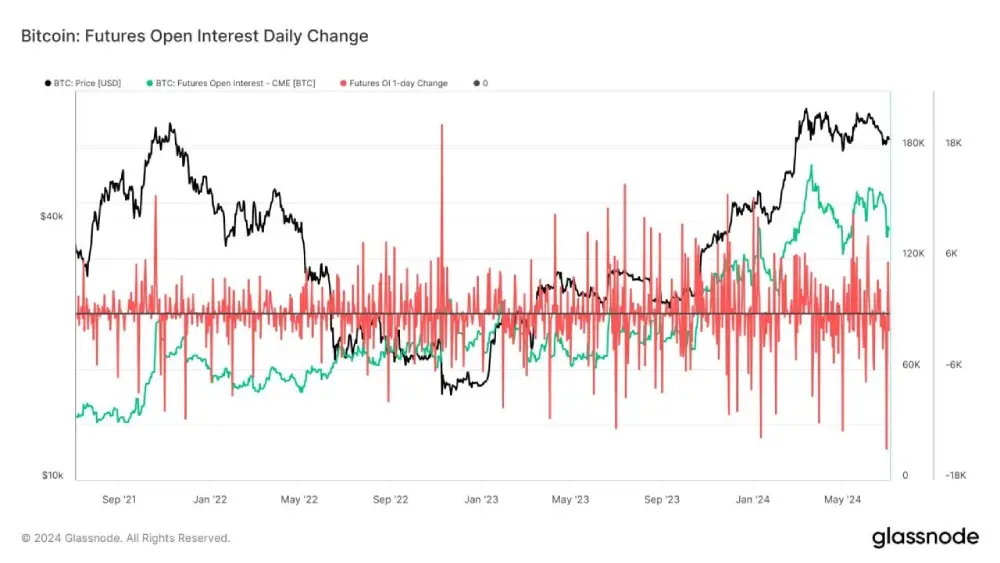

Open interest on CME has fallen by over 40k #Bitcoin since ATH. We just saw the biggest one-day drop in OI on the CME. Closing futures contracts on CME. With a 10% funding rate, underlying trading becomes a little more unattractive Our Social Networks : X.com Telegram Facebook Instagram Our Partner in advertise : Visit our New product where we discuss crypto world :

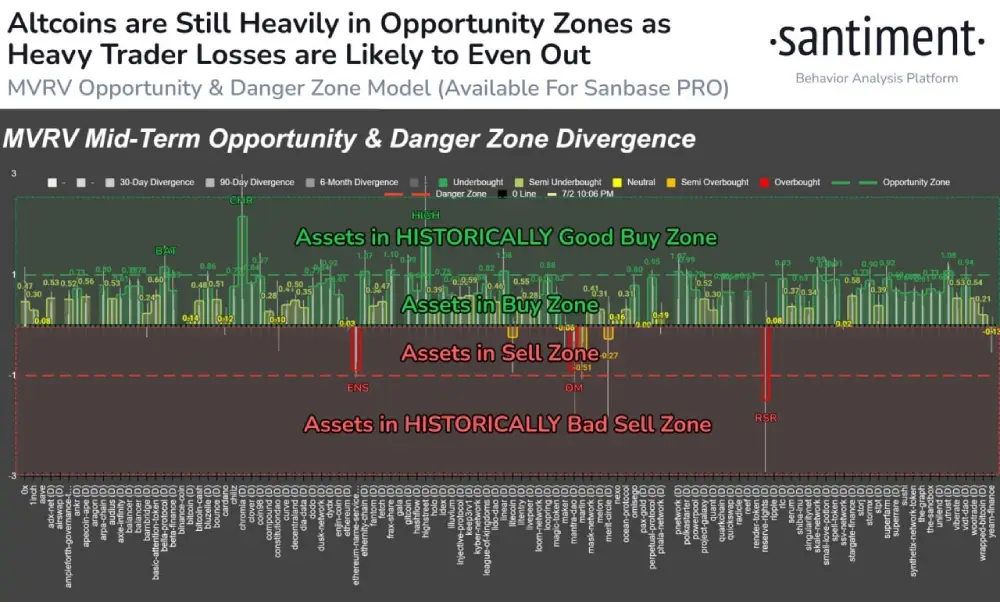

sentiment According to the average returns of each wallet for almost all altcoins, traders are far under water. The Average Realized Value Ratio (MVRV) model shows mathematically viable entry points for BAT, CHR and HIGH. Meanwhile, ENS, OM and RSR are projects you may want to consider while patiently waiting for better times when traders have not yet outperformed the markets. Our Social Networks : X.com Telegram Facebook Instagram Our Partner in advertise : Visit our New product where we discuss crypto world :

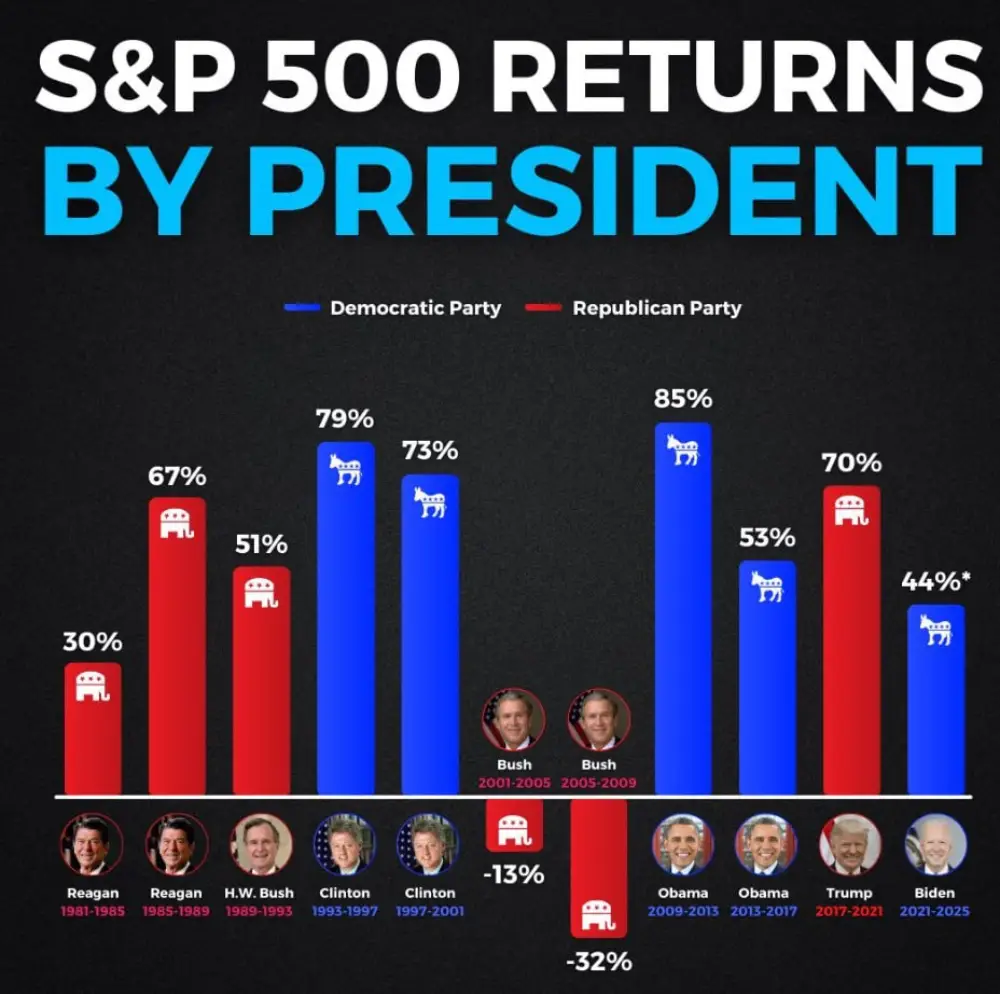

Judging by historical data, the answer is not entirely correct. According to The Motley Fool, the stock market has performed well over the long term under both Democratic and Republican administrations. In terms of average performance, the S&P 500 $SPX has grown 9.8% annually under Democratic presidents, ahead of 6% under Republicans, since 1957. However, if we look at median growth rates, the market grew by 10.2% under Republicans, and by 8.9% under Democrats. While members of either party may argue that the stock market performs better under their party, the direct impact of the policies is difficult to measure. Additionally, presidential terms are subject to the impact of unforeseen events such as the dot-com bubble, the 2008 financial crisis, Covid-19, etc. As always, market timing is the name of the game, not the president's political party. The S&P 500's 10.26% compound annual growth rate is clear evidence of this. Our Social Networks : X.com Telegram Facebook Instagram Our Partner in advertise : Visit our New product where we discuss crypto world :

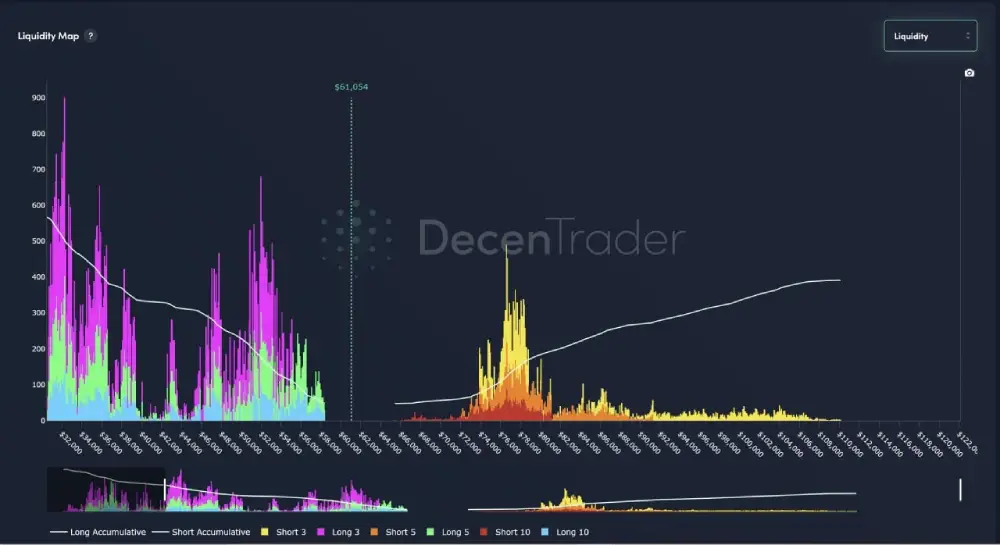

Decentrader *If Bitcoin does break down, $51k - $52k will remain an area where there is a significant amount of liquidity in the form of 3x, 5x and 10x longs. On the upward side, short liquidity is at $76k-78k. Our Social Networks : X.com Telegram Facebook Instagram Our Partner in advertise : Visit our New product where we discuss crypto world :

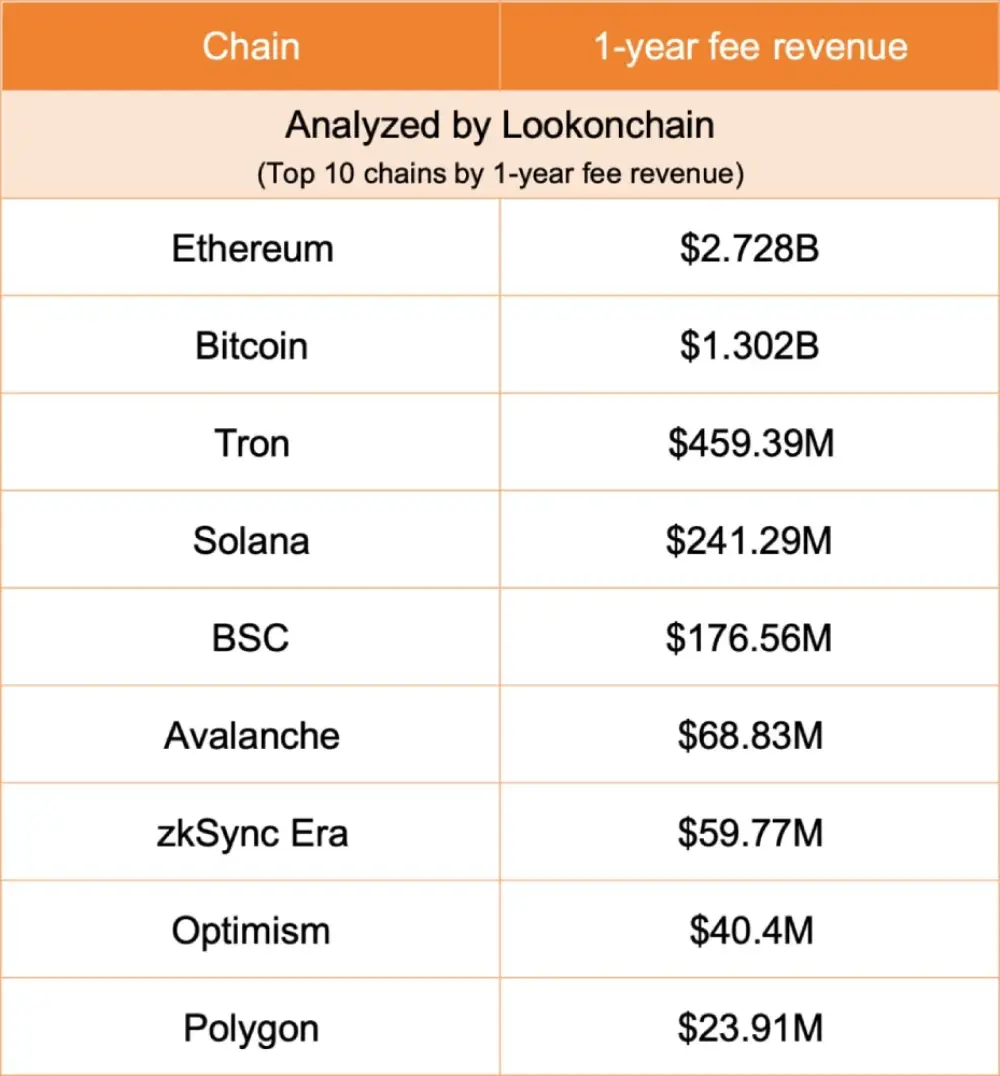

Here are the top 10 networks based on annual fee revenue. #Ethereum earned $2.728 billion per year, #Bitcoin earned $1.30 billion per year, and #TronNetwork earned $459.39 million per year. Our Social Networks : X.com Telegram Facebook Instagram Our Partner in advertise : Visit our New product where we discuss crypto world :

Cathie Wood's Ark Invest ranks as the No. 1 wealth-destroying fund family over the past decade, destroying more than $14 billion, more than twice as much as the second-ranking wealth-destroying fund family. Our Social Networks : X.com Telegram Facebook Instagram Our Partner in advertise : Visit our New product where we discuss crypto world :

Today’s news from the Crypto.Cruspher 03-07-2024 1 . IntoTheBlock: Ethereum spot ETF approval could have a more significant impact on ETH; 2 . The whale/institute sold some of the Ethereum environmental tokens it built at the end of May at a loss, with a total profit of $2.87 million to date; 3 . 10x Research: Long-term technicals, network signals and other Bitcoin indicators temporarily dominate bullish views on US elections and potential interest rate cuts; 4 . Deutsche Digital Assets Lists New Bitcoin Macro ETPI; 5 . Glassnode: Overall returns for Bitcoin investors remain high and more volatility is coming; 6 . The market value of the PoliFi sector has fallen more than 10% in 24 hours, and the next big event could be the election of Vice President Trump; 7 . Starknet Founder: About 400 million STRK are reserved for future airdrop rounds; 8 . Trading volume on the Solana DEX network reached $1.145 billion yesterday, overtaking Ethereum for first place; 9 . Paidun: In the first half of 2024, the cryptocurrency sector lost $1.56 billion due to security incidents and recovered $319 million; Our Social Networks : X.com Telegram Facebook Instagram Our Partner in advertise : Visit our New product where we discuss crypto world :

The round was led by Polychain Capital with participation from BabylonChain, Inc., dao5, Franklin Templeton, Foresight Ventures, Mirana Ventures, Mantle EcoFund and Nomad Capital. Lombard will be launched on Babylon, which will allow BTC to be used to secure other networks based on Proof-of-Stake (PoS). Our Social Networks : X.com Telegram Facebook Instagram Our Partner in advertise : Visit our New product where we discuss crypto world :

The TAO Foundation is investigating this incident. Transactions on the network were completely stopped. It is unknown whether any funds were stolen. Over the past 24 hours, TAO coin has dropped by 14%. Our Social Networks : X.com Telegram Facebook Instagram Our Partner in advertise : Visit our New product where we discuss crypto world :

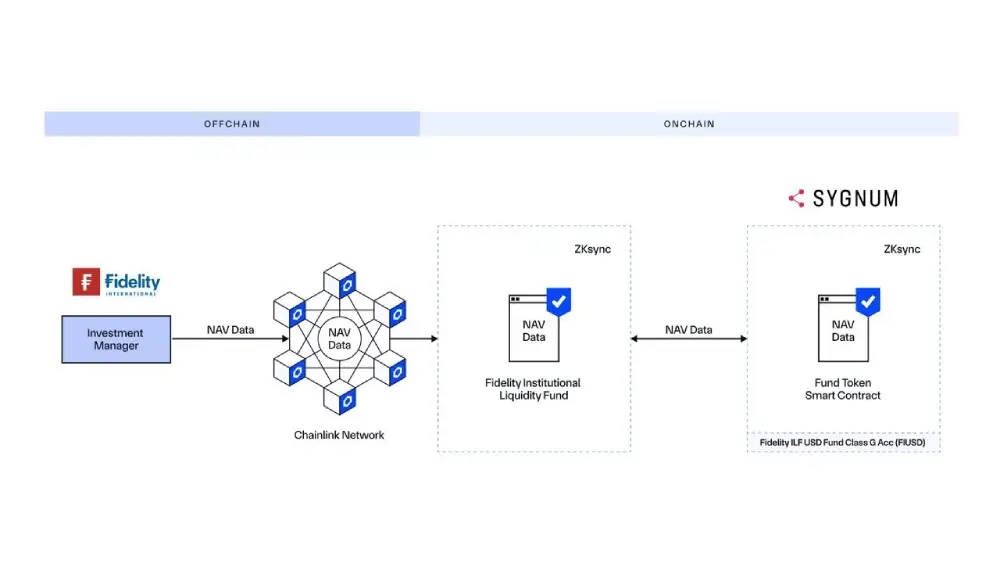

As part of the collaboration, the Institutional Liquidity Fund's net asset value (NAV) data will be available on-chain, allowing it to be updated in real time. This is significantly different from traditional methods, where data is updated only after each trading day. All data will be available to Sygnum bank clients. Our Social Networks : X.com Telegram Facebook Instagram Our Partner in advertise : Visit our New product where we discuss crypto world :

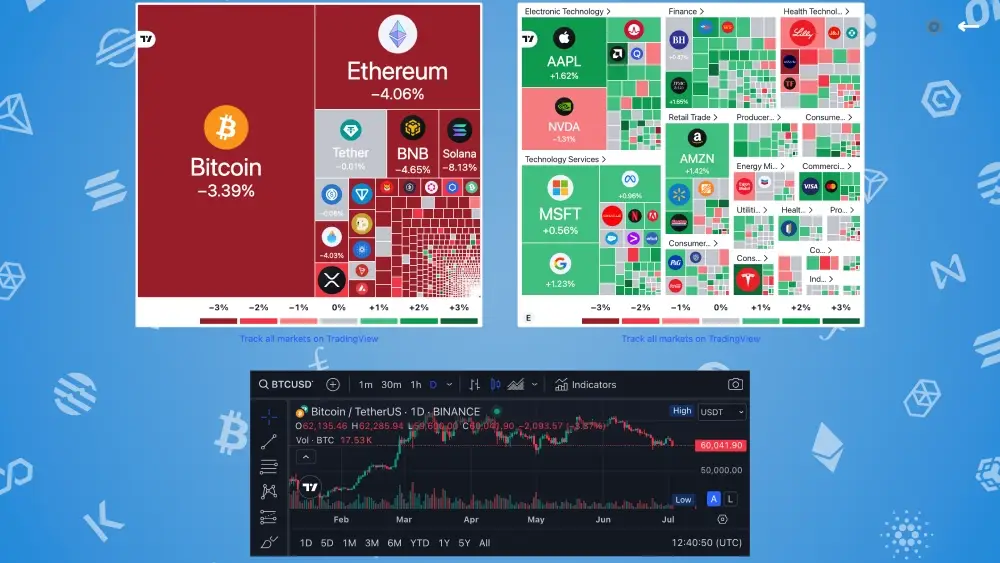

▪️#BTC – $60 167 -4.2%. ▪️🔼 - #TAO , #RUNE , #AAVE , #ENS ▪️🔽 - #- , #- , #- , #- ▪️BTC #dominance- 54.56%. ▪️ #Altseason index 24 ▪️Greed of #investors 50 Our Social Networks : X.com Telegram Facebook Instagram Our Partner in advertise : Visit our New product where we discuss crypto world :