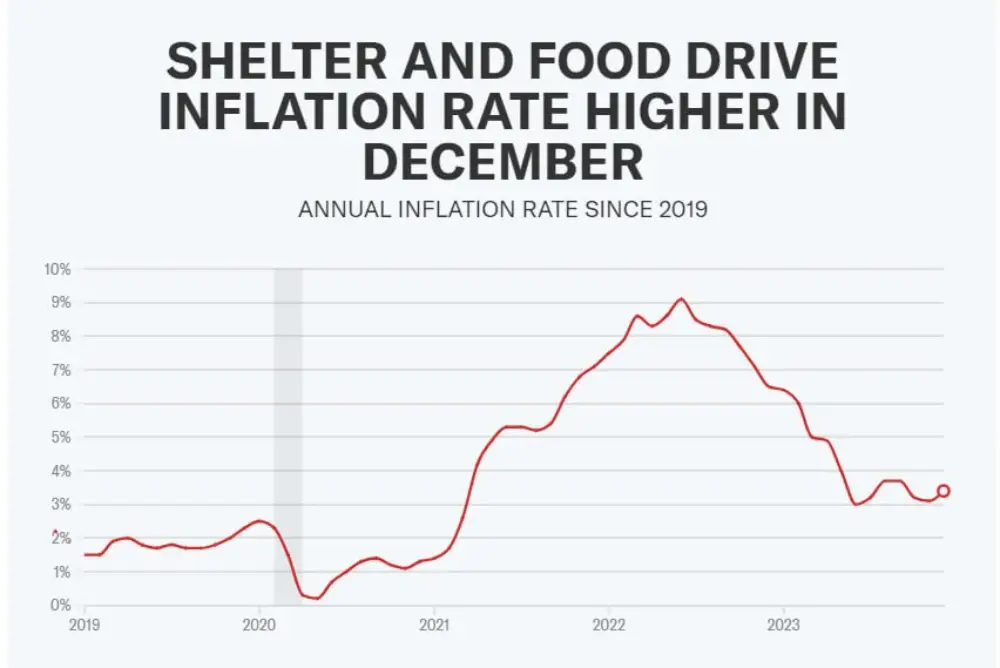

The December consumer price index (CPI) showed a slight increase in prices of 0.3% compared to last month, which is 0.2% more than in November. Compared to the previous year, prices rose 3.4%, up 3.1% from the month before.

Economists had expected prices to rise 0.2% month-on-month and 3.2% year-on-year, according to Bloomberg data.

Excluding the volatile food and energy categories, core inflation fell to 3.9% year-on-year from 4.0% a month earlier. Economists surveyed by Bloomberg expected core inflation to be 3.8%. On a monthly basis, core inflation rose 0.3%, unchanged from the previous month.

The published data will be crucial for investors who, since the release of the latest CPI report, are increasingly assessing the chances of a “soft landing” - a reduction in inflation to 2% without an economic downturn. Such an outcome could mean the central bank's campaign to raise interest rates is over and it can begin cutting rates, reducing borrowing costs for businesses and consumers.

As of early Thursday morning, markets pegged the likelihood of the Fed cutting interest rates in March at about 69%, according to CME's FedWatch tool.

While markets are aggressively pricing in the possibility of interest rate cuts as inflation appears lower, Fed officials are taking a more measured approach.

Fed Chairman Michel Bowman said Monday that while the Fed may eventually have to cut rates if inflation continues to decline, "we haven't reached that point yet."

"We're in a contractionary position and I'm comfortable with that and I just want the economy to continue to grow with us in that position and hopefully keep inflation at our 2% level," he said, according to media reports of his comments.

Our Social Networks :

X.com

Telegram

Facebook

Instagram

Our partner will solve Your problematic :