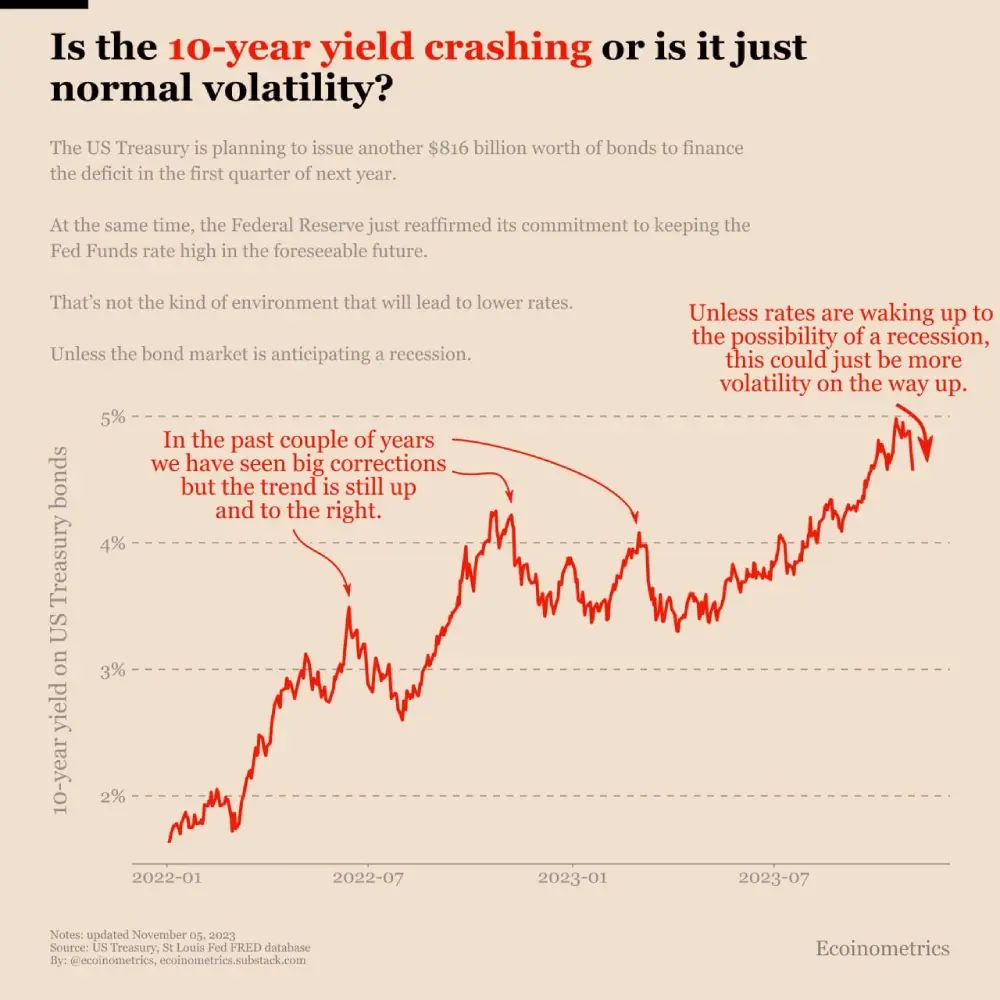

The 10-year yield has fallen significantly since last week. But is this a trend reversal or just normal volatility on the way up?

If you look at the macro situation:

~ The Federal Reserve is keeping rates high.

~ The US Treasury is about to issue bonds worth $816 billion.

This is not an environment that requires lower rates.

Plus we have seen similar corrections 3 or 4 times since 2022. At the same time, rates dropped from less than 2% to 5%.

So it may be too early to talk about a trend reversal.

Except... Except when the bond market expects a recession...

Our Social Networks :

X.com

Telegram

Facebook

Instagram

You can register in 🔸BINANCE🔸 and get good bonuses with us(100$)!!!