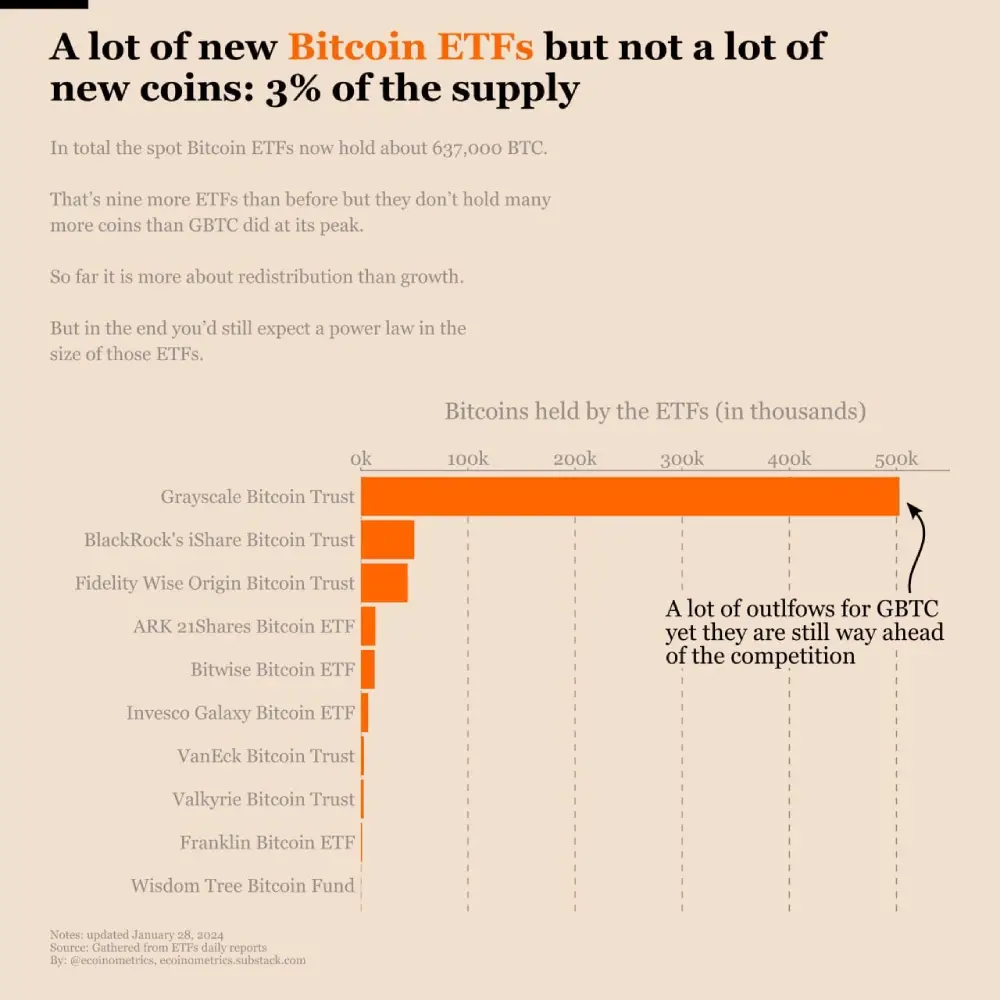

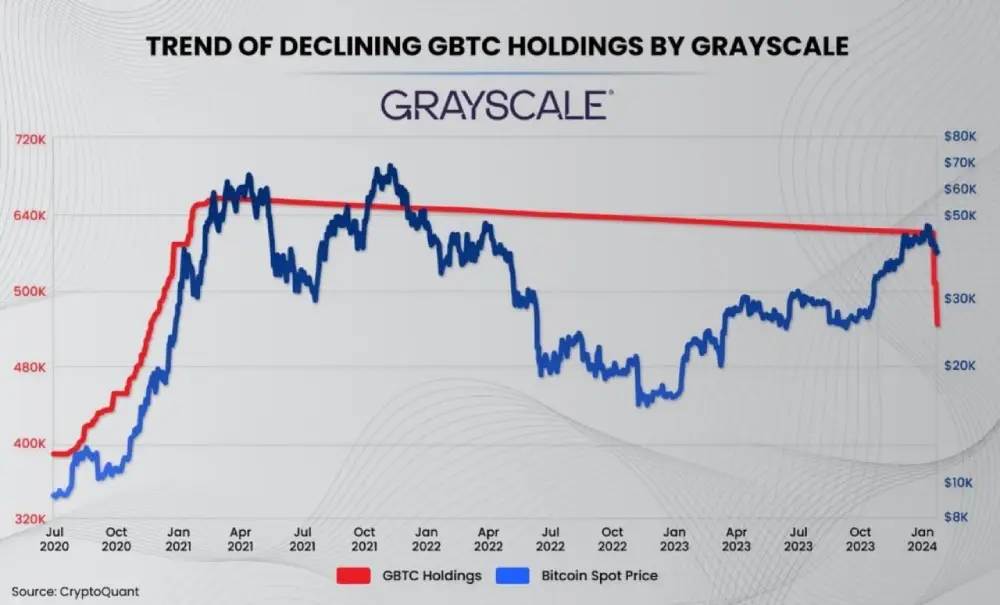

Two weeks ago we went from no real Bitcoin ETFs to ten such funds in the US. Of course, the largest of them, Grayscale Bitcoin Trust (GBTC), has been around for a long time with a different structure. But it's still a step forward. These products are now dotted Bitcoin ETFs. This means that they are backed by real Bitcoins, which are owned by the ETF's operators. When these ETFs receive new money, they turn around and use it to purchase coins. The question is how many coins will be in these Bitcoin funds two weeks after launch. The answer is approximately 637,000 BTC. This is about 3% of the total number of Bitcoins. Is this too much? Well, in its previous form, the Grayscale Bitcoin Trust already held about 635,000 BTC at its peak... so the net effect of these new ETFs is small. And in fact, GBTC alone still represents 2.4% of the total Bitcoin held in the ETF. Our Social Networks : X.com Telegram Facebook Instagram Our partner will solve Your problematic :

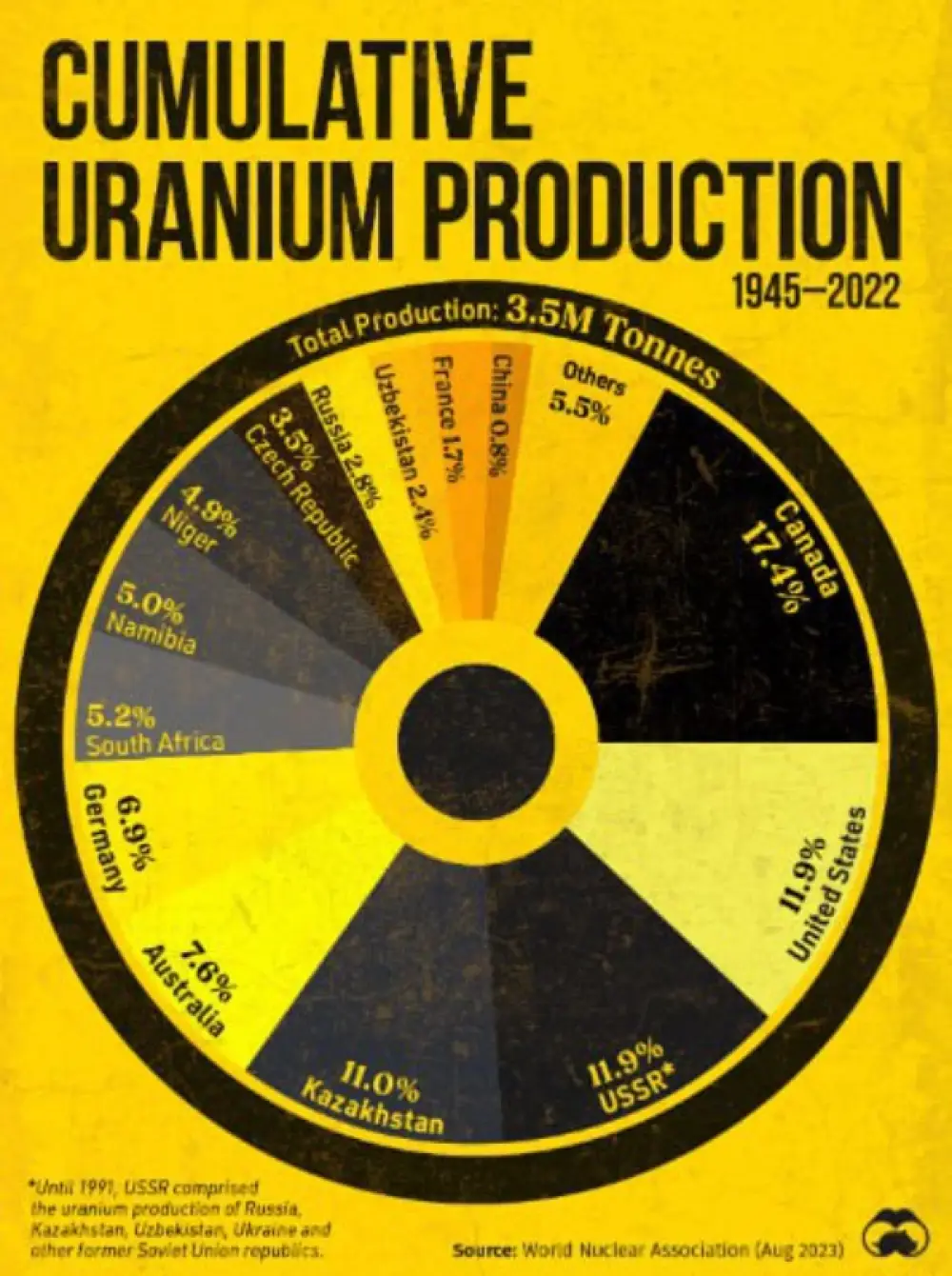

#Uranium is used as fuel for nuclear power plants, nuclear reactors used on warships and submarines, and in nuclear weapons. Meet the main producers of this metal in this infographic Our Social Networks : X.com Telegram Facebook Instagram Our partner will solve Your problematic :

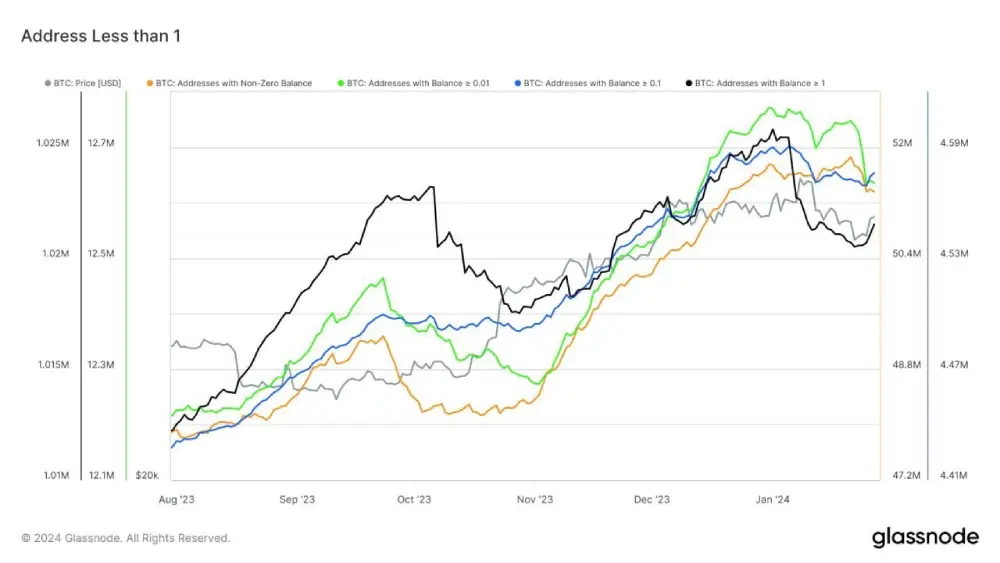

Addresses with less than 1 #Bitcoin have been in a downtrend since reaching the 49k top. Now they all seem to have bottomed and there are signs of consolidation around 40k. Our Social Networks : X.com Telegram Facebook Instagram Our partner will solve Your problematic :

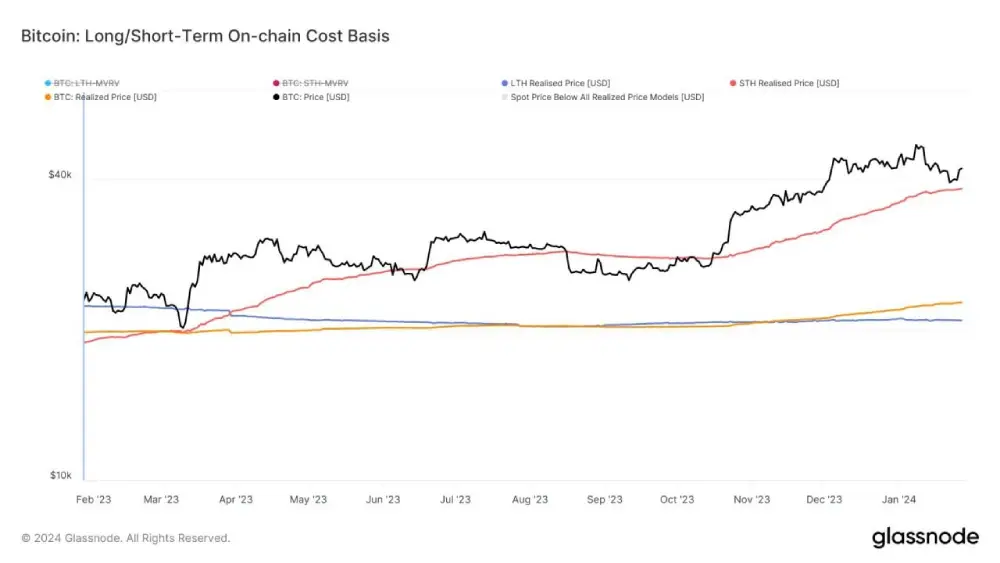

Compare how the correction occurred in 2020 before the bull run began and how it occurs in 2023-24 for a cohort of short-term investors with a holding period of 1-3 months. The metric is presented in the form of an MVRV oscillator. Our Social Networks : X.com Telegram Facebook Instagram Our partner will solve Your problematic :

#Bitcoin dropped to $38.8K, bouncing almost perfectly off the short-term holder's strike price. This level was used as support during previous bull runs. STH RP and RP continue to rise, which is bullish as coins continue to be purchased at a higher price. The last time STH RP was at $38.3k was in 2021, when the price was $60,000. This shows how sustainable this bull run is. Our Social Networks : X.com Telegram Facebook Instagram Our partner will solve Your problematic :

Currently, the $GBTC ETF has sold over 80,000 $BTC (~$3.2 billion) - about 15% of the total $GBTC volume At this rate, $GBTC will end in March, which gives you an idea of how much the sell-off has accelerated. Our Social Networks : X.com Telegram Facebook Instagram Our partner will solve Your problematic :

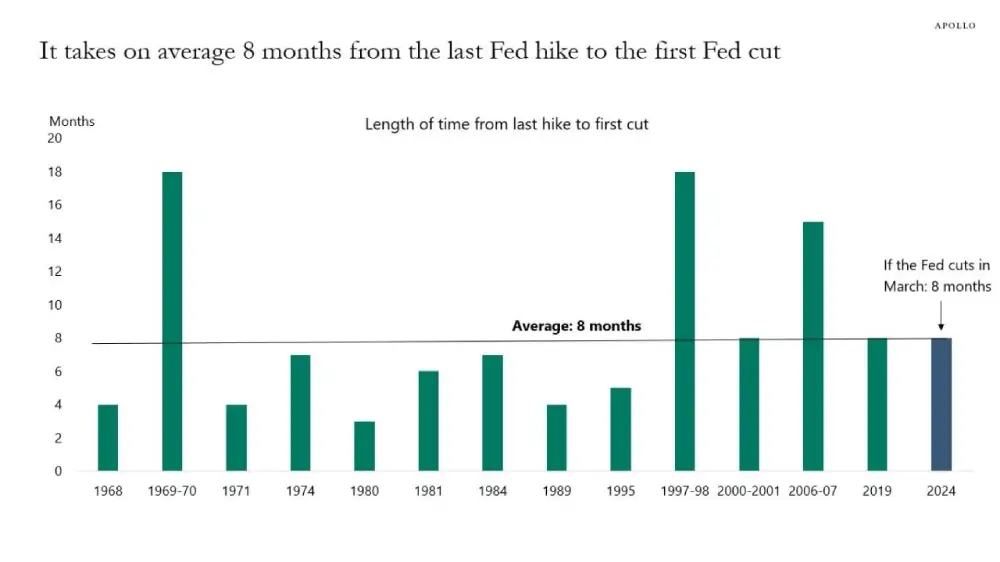

On average, it takes 8 months between the last Fed rate hike and the first Fed rate cut. The Fed's last interest rate increase occurred in July 2023, meaning March 2024 will be exactly 8 months from now. If the Fed cuts rates in March, it will be exactly in line with the average timing of all previous Fed rate hikes and rate cuts. Will history repeat itself in March? Our Social Networks : X.com Telegram Facebook Instagram Our partner will solve Your problematic :

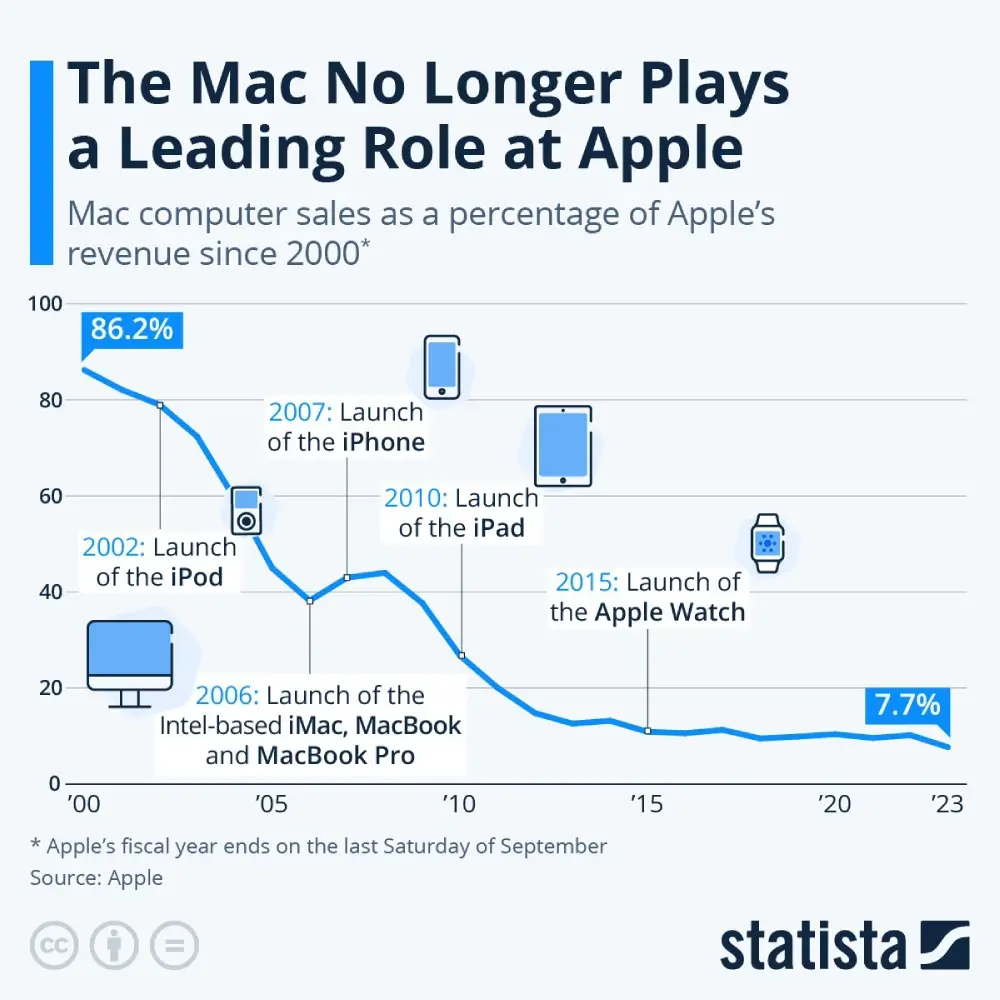

Macs now account for less than 8% of Apple's total $AAPL revenue. In 2000, Mac computers accounted for 86.2% of Apple's revenue. Our Social Networks : X.com Telegram Facebook Instagram Our partner will solve Your problematic :

MacKenzie Scott, the ex-wife of Amazon founder and executive chairman Jeff Bezos, sold more than 65 million shares of $AMZN last year, representing about 25% of the company's total stake. At Friday's closing price, those shares would be worth $10.4 billion. Our Social Networks : X.com Telegram Facebook Instagram Our partner will solve Your problematic :

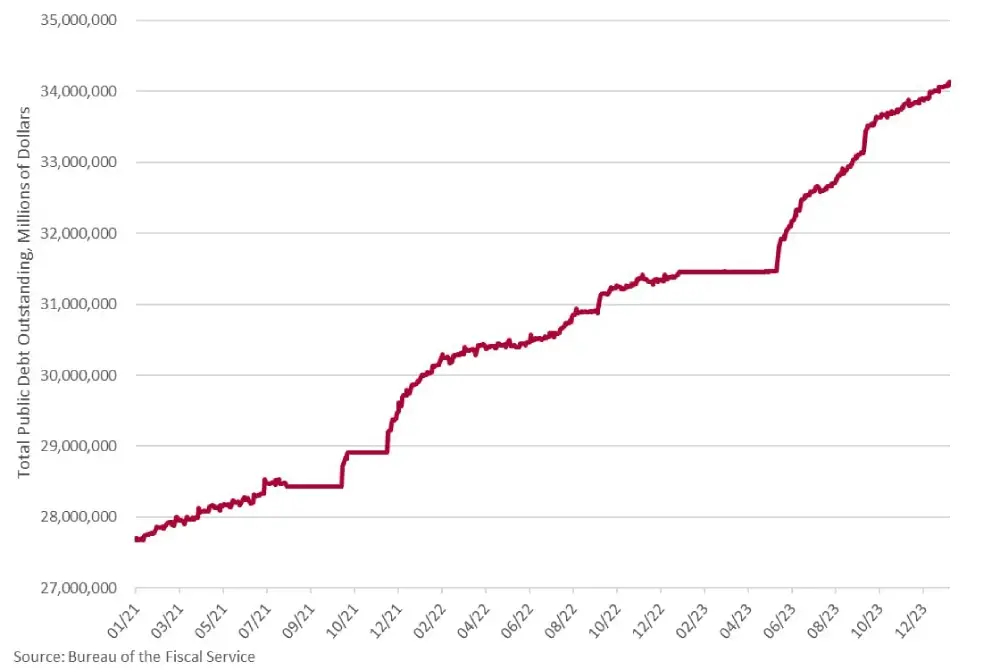

Since the debt ceiling crisis “ended” in June 2023, total US debt has grown by ~$3 trillion. Since October 1, the US government has been borrowing ~$10 billion per day. And what's the worst thing? For the next 340 days, the US debt ceiling is effectively unlimited. If they continue to borrow at current rates, the federal debt could top $37 trillion this year. Mind-blowing numbers. Our Social Networks : X.com Telegram Facebook Instagram Our partner will solve Your problematic :

The Chairman of the CFTC once again recalled the need to create rules for the digital asset market Chairman of the Commodity Futures Trading Commission (CFTC) Rostin Benham once again recalled the need to create new legislation for digital assets. In particular, Benham is concerned about the approval of spot Bitcoin ETFs. According to him, many users of these funds may mistakenly believe that the digital asset industry is already quite transparent. He added that no federal regulator has been given congressional authority over digital asset money markets. “Instead of regulation, ETPs took a speculative and volatile asset, wrapped it in a thin layer of indirect regulation, and packaged it into a shiny new product,” Behnam concluded. Our Social Networks : X.com Telegram Facebook Instagram Our partner will solve Your problematic :

Finnish authorities were able to track a transaction in Monero in the case of hacking the database of a psychological clinic The Finnish National Bureau of Investigation has traced transactions in Monero that are associated with the hacking of the private psychological clinic Vastaamo. Authorities accuse Julius Aleksanteri Kivimäki of hacking the hospital's database. Kivimäki demanded 40 BTC from Vastaamo in exchange for not publishing patient records. However, he did not receive his money and targeted individual patients. When the attacker received money from the clinic’s clients, he sent it to the exchange without KYC and exchanged it for XMR coins. Different wallets were used for storage. The authorities did not disclose any details about how they were able to track transactions in Monero. Our Social Networks : X.com Telegram Facebook Instagram Our partner will solve Your problematic :